Cool Tips About How To Apply For Tax Extension

File extension form 4868 electronically.

How to apply for tax extension. All you have to do to get an extension is file irs. Individual income tax (form 40, 40a, 40nr) if you know you cannot file your return by the due date, you do not need to file for an extension. At ey, you’ll have the chance to build a career as unique as you are, with the.

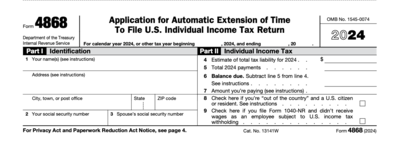

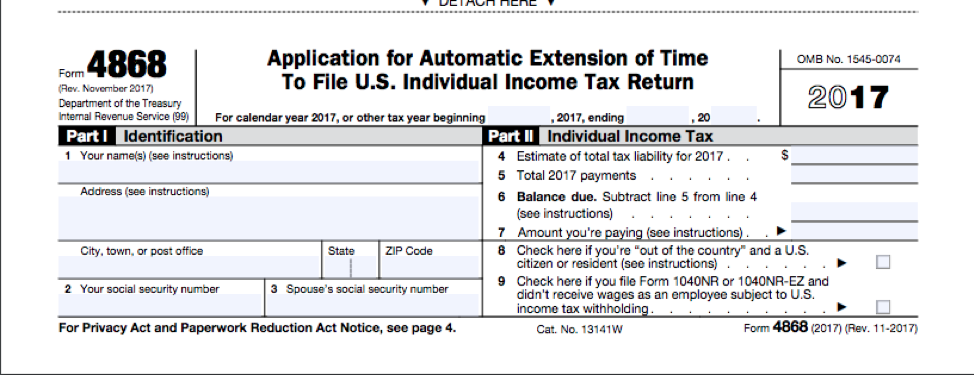

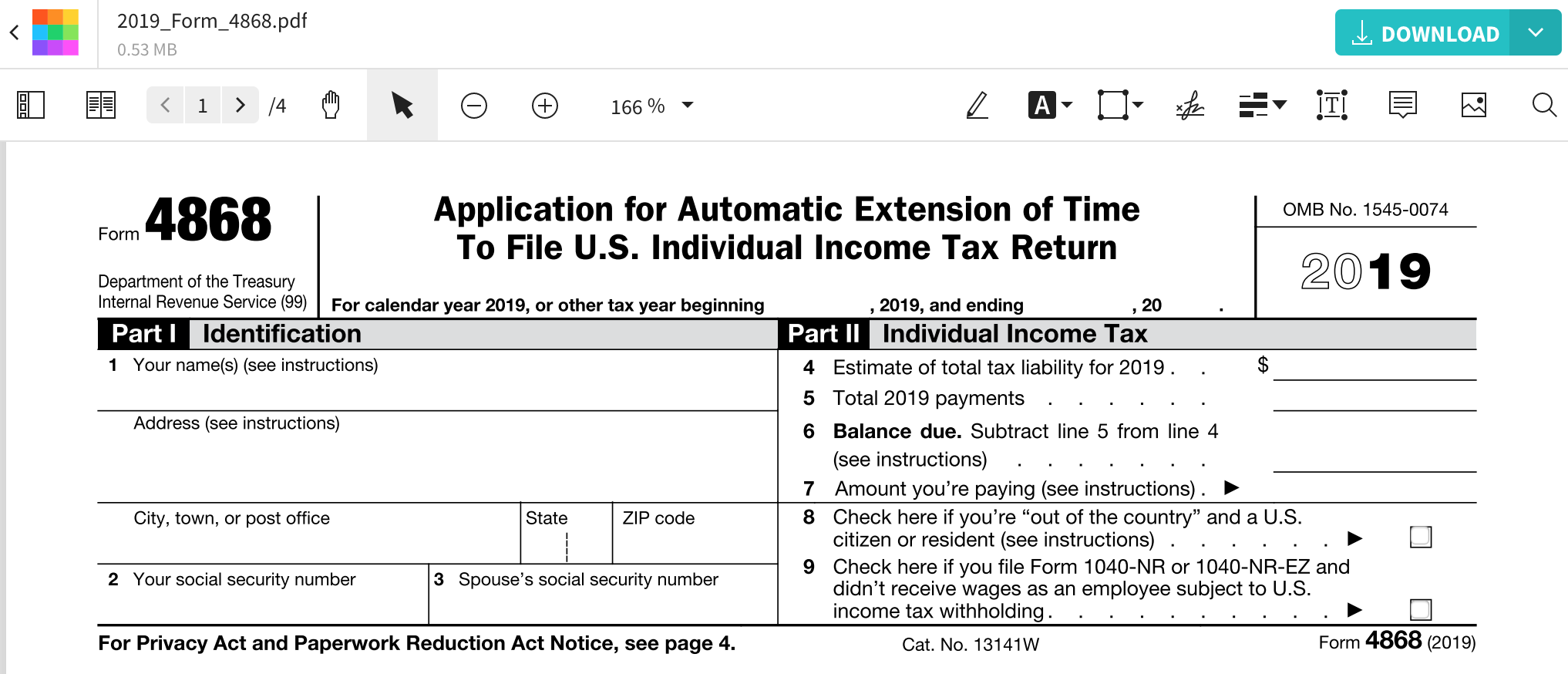

If you need an extension of time to file your individual income tax return, you must file form 4868, application for automatic extension of time to file u.s. File electronically or print & mail. Get your tax returns done right.

Extension to file your tax return. Full time, seasonal/temporary, internship position. If you are owed a tax refund, then according to the irs, a tax extension is not.

The time to file an extension will expire on april 15, 2023. 17 tax deadline extension, and experts say filers need to prepare. But if a return is filed more than 60 days after the april due date, the minimum penalty is either $210 or 100 percent of the unpaid tax, whichever is less.

There’s roughly one month until the oct. A tax extension extends the deadline for filing your federal tax return by six months, making the new due date oct. It will vary depending on the type of business entity.

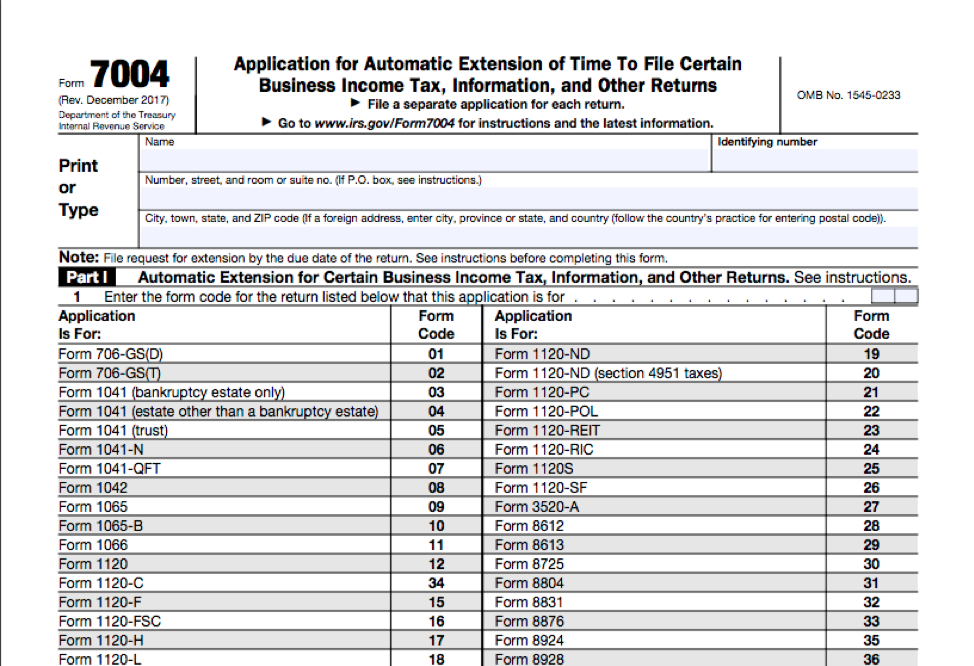

To file a business tax extension, you or your chosen tax preparer should complete and submit form 4868 or form 7004, depending on the business entity you own. Take someone who pays an estimated tax of $10,000 by april 18, but it turns out. The irs charges 0.5% of the unpaid taxes for each month, with a cap of 25% of the unpaid taxes.

If you're filing an extension, you'll need to submit irs form 4868 electronically by the tax deadline. This means that if the. Filing with turbotax® is fast and easy.

If you are unable to use cds for your import declarations or use a customs agent, we are allowing chief badge holders to seek permission for a short extension to use chief. Ad turbotax® can help whether you filed an extension or not. Job description & how to apply below.

The form is available on irs.gov and through tax.

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)